What Is Inventory Management? A Founder's Guide

- GrowthBI

- Sep 11, 2025

- 14 min read

Updated: Sep 12, 2025

Inventory management is the system a company uses to source, store, and sell its stock. It covers the entire path of a product, from raw material to finished good delivered to a customer. This system is a critical financial discipline that directly shapes cash flow, profitability, and customer satisfaction.

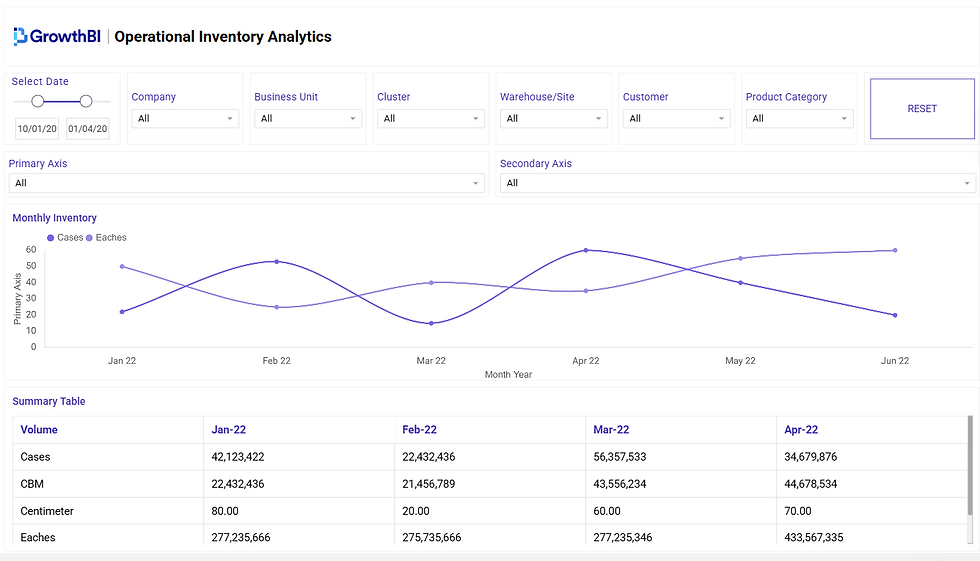

This critical discipline is best understood not just through definitions, but by seeing how inventory data comes to life in real time.

For example, a Store Operations Dashboard gives founders and leaders instant visibility into stock levels, turnover rates, and cash tied up in inventory—helping them make smarter, faster decisions from day one.

Understanding Inventory as a Financial Asset

For any senior leader, viewing inventory as simply items in a warehouse is a missed opportunity. It is the practice of turning physical goods into revenue with maximum efficiency. Poor inventory management puts a serious financial strain on a business by tying up capital in products that do not sell.

Consider a mid-sized e-commerce company with too much cash invested in slow-moving items. At the same time, it runs out of its bestsellers consistently. This creates a disconnect between inventory and financial plans. The results are lost sales and dissatisfied customers.

When inventory and financial data are siloed, it’s easy to lose sight of how stock decisions impact cash flow and profitability.

By integrating inventory management dashboards with financial analytics, leaders can immediately spot slow-moving items, optimize purchasing, and align inventory strategy with business goals.

The Core Purpose of Inventory Management

Effective inventory management provides the data and processes to strike a critical balance. The goal is to meet customer demand without paying the high price of overstocking or losing sales from stockouts. A clear definition of What is Inventory Management is a good starting point.

This discipline helps a business achieve several key goals:

Optimizing Cash Flow - It prevents capital from being locked in unsold goods, freeing up money to invest in growth, marketing, or other operations.

Improving Profitability - It protects and boosts profit margins by cutting storage costs, spoilage, and product obsolescence.

Meeting Customer Expectations - Maintaining the right stock levels means orders can be fulfilled quickly and reliably, which is a major driver of customer loyalty.

The central idea is simple but powerful - treat inventory as an active, working asset rather than a passive cost.

From Cost Center to Advantage

Let's break down the core functions of inventory management and how they directly affect a company's bottom line.

Core Components of Inventory Management

Component | Description | Impact on Business |

Purchasing & Sourcing | The process of acquiring raw materials or finished goods from suppliers. | Directly influences cost of goods sold (COGS) and supplier relationships. |

Warehousing & Storage | The physical management of stock, including receiving, storing, and organizing goods. | Affects operational efficiency, storage costs, and risk of damage or loss. |

Order Fulfilment | The entire process from a customer order to delivery, including picking, packing, and shipping. | Crucial for customer satisfaction, repeat business, and brand reputation. |

Tracking & Auditing | The use of systems to monitor stock levels, locations, and movements in real-time. | Minimizes stockouts and overstocking, improves accuracy, and reduces theft. |

By managing these components well, a company moves beyond counting boxes and starts making data-informed decisions.

When handled correctly, inventory data provides valuable insights into business performance. It shows which products generate profit, helps spot seasonal demand spikes, and highlights operational bottlenecks.

By making inventory management a proactive financial plan instead of a reactive operational task, leaders can achieve greater clarity and control over their business's health and direction.

This mindset allows a business to react to market changes with agility. Instead of just knowing what is on the shelves, leaders can use inventory data to make better decisions on purchasing, production, and sales. It becomes a genuine tool for building a more resilient and profitable organization.

The Four Stages of the Inventory Lifecycle

To gain control over inventory, a leader must understand how it moves through the business. This movement is the inventory lifecycle, and it has four clear stages. Each stage presents its own challenges and opportunities to make operations smoother and protect the bottom line.

A manufacturer must have the right raw materials ready without tying up cash. A hospital must have critical medical supplies on the shelf to save lives.

1. Ordering and Replenishment

The cycle begins before stock arrives. This first stage, ordering and replenishment, involves deciding what to buy, how much to buy, and when to buy it. This balancing act requires a sharp eye on sales data, supplier delivery times, and market conditions.

Mistakes at this stage cause immediate problems. A construction company that over-orders steel has a massive amount of cash tied up in materials that are difficult to store. Conversely, ordering too little can bring a multi-million dollar project to a halt, triggering costly delays and penalties.

The real goal is to keep operations running smoothly without creating a financial headache. This stage involves a few key activities:

Demand Forecasting - Analyzing past sales and market trends to predict what customers will want next.

Setting Reorder Points - Determining the minimum stock level that should automatically trigger a new purchase order. This acts as a safety net.

Supplier Management - Building solid relationships with vendors, negotiating good terms, and confirming they can deliver on time.

2. Receiving and Storing

Once a delivery arrives, the business enters the receiving and storing stage. This is a crucial checkpoint. At this point, the company inspects incoming goods, checks them against the purchase order, and logs everything into its system. This is the chance to catch any damaged items, shortages, or quality issues before they cause larger problems.

After check-in, the items go to storage. A messy or disorganized storage system is a recipe for operational problems. Stock can easily get lost, damaged, or sit on a shelf until it expires, turning a valuable asset into a complete write-off.

Imagine a law firm storing sensitive client documents or a university managing expensive lab equipment. In these cases, a sloppy storage process can lead to serious compliance breaches or operational chaos.

Good storage is a system designed for fast retrieval, smart use of space, and minimal risk of loss. It actively protects an investment.

3. Picking, Packing, and Shipping

The third stage, picking, packing, and shipping, is the core of fulfilling an order. A customer places an order, and the team must find the right items in the warehouse, pack them securely, and send them to the correct address. Customer happiness depends almost entirely on the speed and accuracy of this process.

A slow, error-prone fulfillment process damages a company's reputation. An e-commerce brand that repeatedly sends the wrong shirt size or takes weeks to deliver will struggle to retain customers. Every mistake has a cost, from paying for return shipping to the staff time required to resolve the issue.

Success at this stage comes down to a well-organized warehouse, clear procedures, and a well-trained team. That is the combination for getting the right order to the right person, on time.

4. Returns Management

The process does not always end with a satisfied customer. The final stage is returns management, sometimes called reverse logistics. This is the process for handling products that customers send back. It involves receiving the return, inspecting it, and deciding what to do next - restock it, repair it, or write it off.

Many businesses treat returns as an afterthought, which is a significant mistake. A clunky returns process frustrates customers and can hurt profits. A returned item sitting in a corner unprocessed loses value daily.

This process applies beyond physical products. For a SaaS company, this could be processing a subscription cancellation. For a car manufacturer, it is handling a warranty claim. A smooth, organized returns process is key to protecting profits and maintaining customer trust.

Critical Metrics for Measuring Inventory Health

Effective leaders use solid data to make smart decisions rather than rely on intuition. For inventory, its health cannot be known without tracking the right metrics. These Key Performance Indicators (KPIs) tell the financial story of stock, showing exactly how hard capital is working.

Simply put, what gets measured gets improved. Operating without clear data means a business cannot spot expensive problems or act on hidden opportunities. These metrics provide the clarity needed to check operational health and fix issues before they hurt profits. A business can explore a broader set of top operational KPI examples to get a more complete picture of its performance.

Inventory Turnover Rate

One of the most revealing figures is the Inventory Turnover Rate. This metric shows how many times a business sells and replaces its entire inventory over a set period, usually a year. It directly measures how effectively a company moves product.

A high turnover rate is generally a good sign, indicating strong sales and smart purchasing. A low rate, on the other hand, is a red flag. It suggests cash is tied up in slow-moving items, which increases holding costs and the risk of stock becoming obsolete.

Consider a construction company with a low turnover rate for its raw materials. That signals overbuying, which locks up cash that could be used for new project bids or equipment upgrades. This directly squeezes project profitability and overall cash flow.

In Australia, effective inventory management often centers on this metric. To calculate it, divide the cost of goods sold (COGS) by the average inventory value. For instance, if a business has an annual COGS of AUD 1,000,000 and an average inventory of AUD 200,000, its inventory turnover rate is 5. This means it completely cycles through its stock five times a year, a positive sign of healthy cash flow and minimal holding costs.

Tracking turnover rates and other KPIs is far more actionable when visualized.

A dedicated Inventory Performance Dashboard highlights trends in turnover, stockouts, and holding costs which makes it easy to identify issues before they become costly problems.

Gross Margin Return on Investment (GMROI)

While turnover measures speed, Gross Margin Return on Investment (GMROI) is about profitability. This metric calculates the gross margin earned for every dollar invested in inventory. It helps identify which products are genuinely generating profit.

A GMROI greater than 1 means the company is selling goods for more than they cost. If it drops below 1, the company is losing money on that stock.

Leaders use GMROI to make better decisions about what to buy and how to price it. An e-commerce retailer, for example, might find that a popular, high-turnover product actually has a poor GMROI. Even though it sells fast, it contributes little to the bottom line. This insight allows the retailer to adjust its pricing or marketing approach to fix the problem.

Formula - Gross Margin / Average Inventory Cost

What it reveals - The real profit the inventory investment is generating.

Business application - Pinpoints which products deliver the best financial returns.

Days Sales of Inventory (DSI)

Days Sales of Inventory (DSI), sometimes called Days Inventory Outstanding, calculates the average number of days it takes for a company to convert its stock into a sale. It is another way of looking at inventory speed, expressed in time rather than as a ratio.

A lower DSI is the goal, as it shows a business can turn inventory into cash more quickly. A high DSI, however, might signal overstocking or weak customer demand. For a healthcare provider, tracking DSI on critical medical supplies is crucial. It helps them prevent costly expirations while having life-saving equipment on hand without overstocking.

Stockout Rate

The Stockout Rate measures how often an item runs out, shown as a percentage of total orders. This KPI directly reflects a company's ability to meet customer demand and can highlight serious problems in its forecasting or reordering processes.

A 0% stockout rate might seem ideal, but it could actually indicate overstocking and wasted money on holding costs. The real goal is to find the right balance. A high stockout rate for a manufacturer's key component can halt production, while for a retailer, it means lost sales and unhappy customers. Watching this rate helps a company fine-tune its reorder points and safety stock levels.

Proven Inventory Management Techniques

Choosing the right inventory management technique means picking the right tool for the job, a method that solves a specific business problem.

Different approaches work well under different circumstances, depending on industry, products, and cash flow. For leaders, understanding these techniques provides a clear framework for turning inventory into a financial asset rather than a liability. The right approach cuts waste, frees up capital, and supports company growth.

Just-In-Time (JIT) Inventory

The Just-In-Time (JIT) method is straightforward - goods arrive from suppliers only as they are needed for production or sale. This approach drastically reduces the need for on-site storage, which can slash warehousing costs.

Consider a mid-sized company that manufactures car parts. With JIT, it orders steel and rubber to arrive just before they are needed on the assembly line. This eliminates the cost of storing large stockpiles of raw materials.

The biggest benefit is the major reduction in carrying costs. But JIT has a dependency. It demands highly reliable suppliers and accurate demand forecasting. One disruption in the supply chain can bring entire production to a halt, making it a high-risk approach for businesses without a solid supplier network.

ABC Analysis

ABC Analysis is a way to prioritize inventory based on its value to the business. The idea is simple but powerful - categorize items into three groups based on their value.

This method helps focus energy where it matters most. Instead of treating every item with the same level of attention, a company concentrates on the products that drive its bottom line.

Category A - These are the top performers. They typically represent 70-80% of total inventory value but only make up 10-20% of stock items. These demand tight control and frequent monitoring.

Category B - These are middle-tier items, accounting for about 15-25% of value and 30-40% of stock. They need moderate attention.

Category C - These are low-value, high-quantity items. They might make up only 5% of inventory value but can be 40-50% of total items. These can be managed with looser controls.

For an e-commerce business, an ABC analysis might show that a few high-end electronics (Category A) generate the vast majority of revenue. By focusing on keeping these in stock, the retailer maximizes sales while using simpler, automated reordering rules for low-cost accessories (Category C). This sharpens focus on what drives performance, a key concept covered in this CEO's guide to operational metrics.

First-In, First-Out (FIFO)

The First-In, First-Out (FIFO) method operates on a simple principle - the first stock bought is the first stock sold. This is critical for any business dealing with perishable goods or products that can become obsolete, as it prevents spoilage and waste.

Imagine a pharmacy managing its medication stock. By using FIFO, the clinic makes sure that drugs with the earliest expiry dates are used first. This prevents waste and, most importantly, protects patient safety.

Adopting FIFO becomes a quality control standard. It maintains product freshness and upholds a brand's reputation, which is critical for anyone in food, beverage, or healthcare.

While FIFO is necessary for perishables, it also works well for non-perishable goods to keep inventory fresh and current. To improve stock control, it is worth exploring the top 10 best practices for inventory management that can help fine-tune stock levels across the board.

Comparison of Inventory Management Techniques

To help decide which approach might fit a business, here is a quick side-by-side comparison of these common methods.

Technique | Best For | Primary Benefit | Potential Challenge |

Just-In-Time (JIT) | Businesses with reliable suppliers and predictable demand. | Minimizes carrying costs and waste. | Vulnerable to supply chain disruptions. |

ABC Analysis | Companies with a wide variety of SKUs. | Focuses resources on high-value items. | Requires regular analysis to keep categories accurate. |

First-In, First-Out (FIFO) | Industries with perishable or time-sensitive goods. | Prevents spoilage and obsolescence. | Can be more complex to track physically. |

The best technique, or combination of techniques, depends entirely on operational realities. The key is to choose a system that provides control and aligns with financial goals.

Using Technology to Modernize Inventory Systems

Running a modern business on manual spreadsheets and outdated systems is a formula for failure. It creates friction, hides what is really happening with stock, and is prone to human error. When the market shifts, the business is left scrambling. Technology provides the control and clarity needed to handle today's complex supply chains.

The first, most crucial step is to implement a dedicated inventory management system. This creates a single source of truth for the entire operation. It centralizes data, automates tedious jobs, and replaces assumptions with real-time facts.

Consider a mid-sized distribution company that made the switch. After replacing spreadsheets with a proper software system, the results were almost immediate. Picking errors dropped by 30%, orders shipped faster, and managers could see exactly what was happening across all warehouses at once for the first time.

The shift from manual tracking to automated dashboards transforms accuracy and operational control.

With real-time dashboards, managers can monitor picking errors, fulfillment speed, and warehouse performance at a glance, driving immediate improvements across the supply chain.

Key Technologies for Inventory Control

Once that software foundation is in place, a business can add tools that provide even greater accuracy and speed. These technologies separate a good operation from a great one.

Barcode Scanners - The barcode scanner is a significant tool. It makes receiving stock, picking orders, and performing stocktakes fast and simple, practically eliminating the manual data entry errors that cause so many problems.

RFID Technology - If barcodes are a big step up, Radio-Frequency Identification (RFID) is a major leap. Tags are attached to products, which then communicate with a reader. An entire pallet of goods can be counted in seconds without needing to see or scan each individual item.

To bring inventory control into the 21st century, it is worth looking into how these advanced tools can work for a business. For example, the specific application of RFID tags for clothing inventory control shows how powerful this technology can be for achieving near-perfect stock accuracy in industries like retail.

The Influence of AI and Cloud Computing

The most forward-thinking inventory systems are now built with artificial intelligence (AI) and cloud computing at their core. These tools are becoming accessible for any company that wants to grow.

AI algorithms can analyze historical sales data, spot market trends, and produce demand forecasts that are far more accurate than any human could manage. Because these systems are cloud-based, that critical information is available anywhere, anytime, connecting the warehouse floor to the sales team and the boardroom.

Technology changes inventory management from a reactive, manual chore into a proactive, data-driven plan. It is the foundation for making better decisions and gaining a real competitive edge.

These advancements are making a huge impact on the Australian retail sector, especially for businesses in fashion and sporting goods. Adopting software that uses AI and cloud computing is no longer a luxury - it has become standard practice. These tools provide the instant stock insights and forecasting needed for Australian retailers to avoid overstocking, prevent stockouts, and keep their customers satisfied.

By bringing all this technology together, leaders can finally treat inventory as the asset it is. It provides the visibility needed to optimize stock levels, free up cash flow, and build a supply chain that can weather any disruption.

Connecting Inventory Data to Business Plans

Raw inventory data, on its own, is just a collection of numbers in a spreadsheet or warehouse system. The value emerges when that data gets analyzed. It changes from a simple stock count into a powerful source of business intelligence, moving the conversation from the warehouse floor into the boardroom.

For a CEO or business leader, this means getting a live, clear picture of the company's health. Modern BI dashboards can instantly show how inventory levels affect sales trends and, most importantly, cash flow. This clarity allows leaders to be proactive in their decisions instead of reacting to problems constantly.

This view is more critical than ever. Recent figures from the Australian Bureau of Statistics show that inventories held by Australian businesses have been increasing, rising about 2.7% over three years to hit AUD 47 billion in March 2025. This steady increase shows how businesses are trying to balance supply chain risks against what customers are actually buying. The full Australian industry outlook provides deeper insight into these trends.

From Data Points to Decisions

When inventory data is combined with sales and financial information, a business gets a single, unified view of its operations. This complete picture reveals real advantages. Suddenly, leaders can answer tough, critical questions with genuine confidence.

Cash Flow Management - How much working capital is sitting on a shelf as slow-moving stock? How can that cash be freed up to invest in growth?

Profitability Analysis - Which products provide the best return on investment (GMROI)? Should the company buy more of them or increase marketing efforts behind them?

Market Responsiveness - Is there a dip in sales for a key product? Is this an early warning sign that requires a change before it becomes a major problem?

This integrated approach turns inventory numbers into a forecast for business performance. A company can learn how to implement business intelligence to get this level of insight.

Building a Resilient Organization

When leaders can clearly see the links between stock levels, product sales velocity, and the company's financial health, they can manage their money much more effectively. They can spot risks before they become major issues and act on opportunities faster than their competitors.

Modern inventory management, powered by business intelligence becomes a core piece of a resilient business plan, providing the clarity needed to handle market shifts and build sustainable growth.

This data-driven thinking helps a business build a more agile and durable organization. It replaces assumptions with facts, giving the leadership team the confidence to make the smart, informed decisions that set market leaders apart.

Ready to connect your inventory data to your high-level business plans? GrowthBI builds custom Power BI dashboards that give you real-time visibility into the metrics that matter, helping you make smarter, data-driven decisions. Find out more at https://www.growthbi.com.au.